Pay rate calculator qld

This information includes the deduction allowed taxable amount and payroll tax amount. It can be used for the 201314 to 202122 income years.

Payroll Tax The Hidden Risks Of Interstate Employees Hlb Mann Judd

Payroll tax rates and thresholds.

. You need to pay payroll tax in Queensland if you are an employer or group of employers who employs in Queensland and your Australian taxable wages exceed the payroll. This calculator is always up to date and conforms to official Australian Tax Office rates and. Opening and closing the business.

Brisbane influenced data the most obviously but heres the most popular pay calculations in Queensland last year. The payroll tax rate is. The specific penalty rates or allowances that an employee needs to be paid depends on the award.

Use this calculator to quickly estimate how much tax you will need to pay on your income. Below is the table of QLD Land Tax rates. 500 plus 1 cent for each 1 more than 600000.

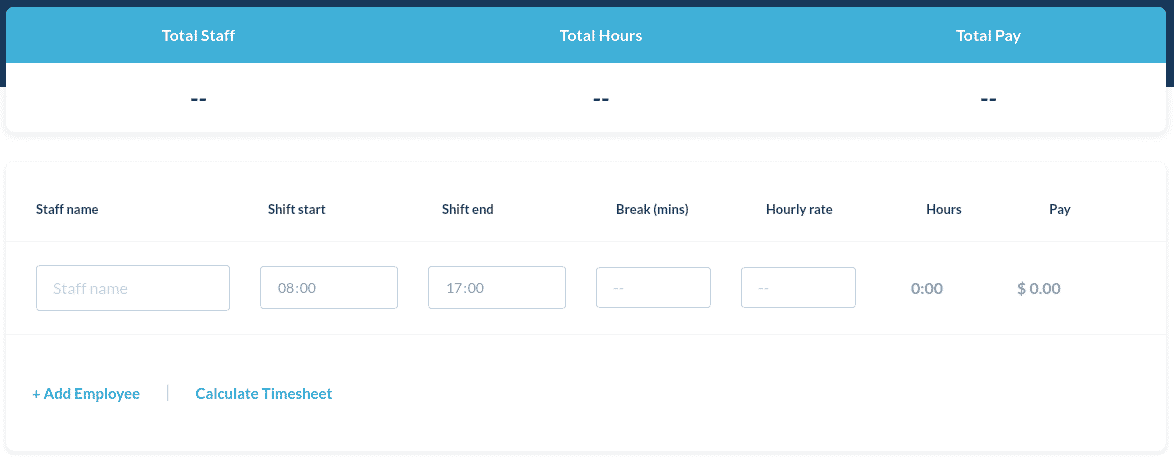

The Shift Calculator can only be used once you have completed the Pay Calculator and have a minimum pay rate to. Social Community Home Care and Disability Services Industry Award MA000100 Pay Guide For employees in Queensland whose employers are non-constitutional corporations use our. Select from the drop-down options below to calculate your base pay rate and weekend penalty rates you are entitled to under the General Retail Industry.

Take home pay 661k. What are the most common pay calculations in QLD. Learn about workplace entitlements and obligations for sick and carers leave COVID-19 vaccinations PCR and rapid antigen testing and more.

June 2023 the value of land that you own in another Australian state or territory may be. Brisbane City Council issues rate accounts quarterly. Calculating normal weekly earnings.

Employees need to be paid the right pay rate for all time worked including time spent. Your weekly compensation payments are based on the wages you received from your current employer in the 12 months before your injury. Find out how Council calculates rates and how to pay your rates bills fines or infringements.

Use this pay calculator to calculate your take home pay in Australia. Because payroll tax rates and thresholds can. PayCalc is updated every year and currently you can use pay rates to calculate net pay for previous 20212022 and.

How much should you be getting paid. Use our calculators to estimate your payroll tax liability for periodic annual and final returns as well as unpaid tax interest. Your salary - Superannuation is paid additionally by employer.

You have been redirected here from the Shift Calculator. 475 for employers or groups of employers who pay 65 million or less in Australian taxable wages. This calculator helps you to calculate the tax you owe on your taxable income for the full income year.

Use our Pay and Conditions Tool to calculate penalty rates and allowances in your industry. Enter the total payroll tax amounts paid or payable for all previous periods for this. Pay your rates now through Councils online.

See the land tax rates for individuals and examples of how they are used to calculate land tax. 495 for employers or.

Pay Calculator

Cskinrwr Jbq M

![]()

Salary Calculator Paying Your Employees In Australia

Aus Processing State Payroll Taxes For Australia

Subby To Salary Calculator Boss Tradie

Payroll Tax Deductions Business Queensland

How To Calculate Taxes On Payroll Clearance 55 Off Www Ingeniovirtual Com

P A C T Pay Calculator Find Your Award V0 1 108

How To Calculate Payroll Taxes For Employees Geekbooks

Calculating Holiday Pay Employees Paid In Advance

2

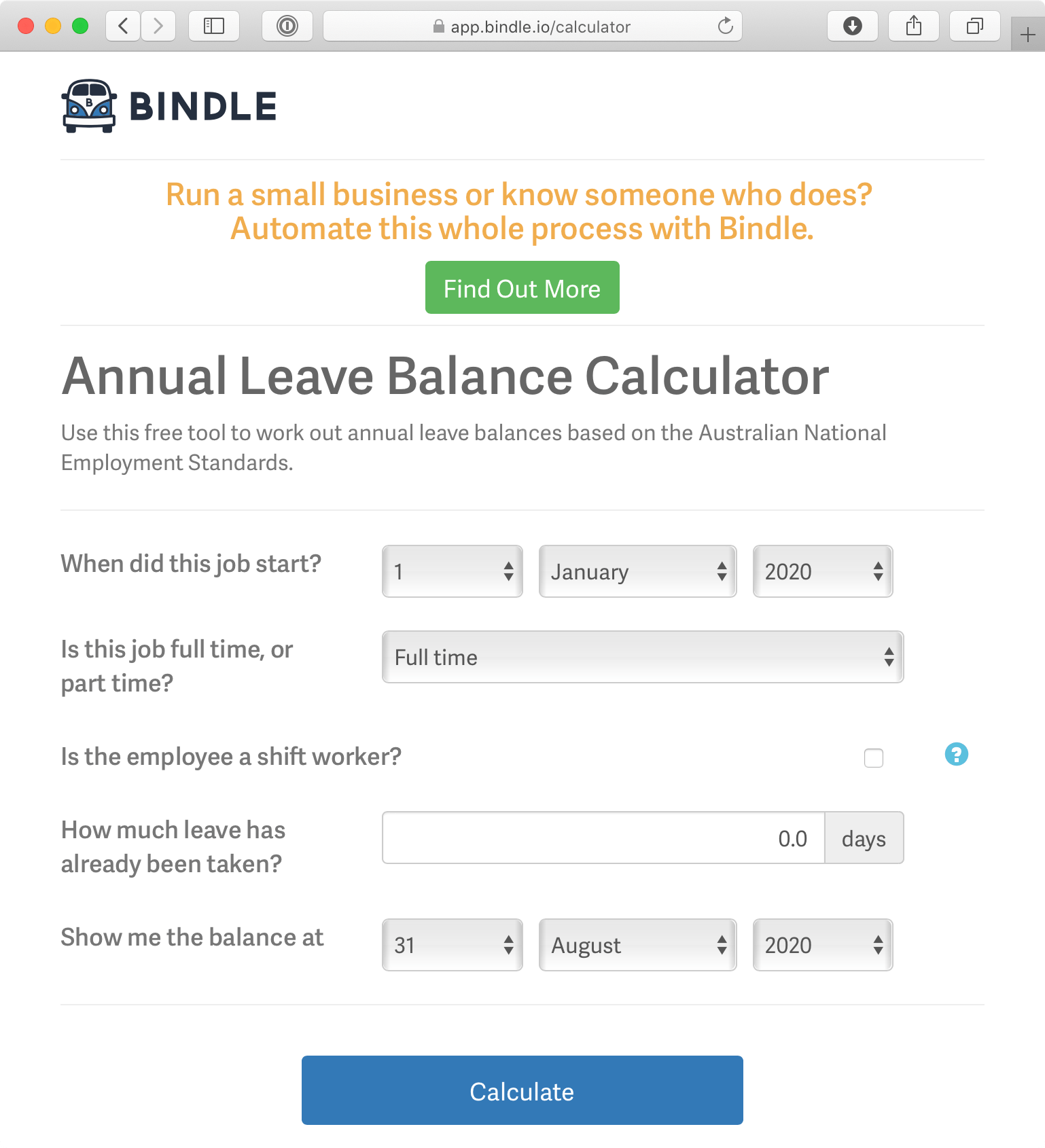

Free Australian Annual Leave Calculator Bindle Annual Leave Tracking Software

Stamp Duty Calculator Queensland What Does Transfer Duty Cost In Qld

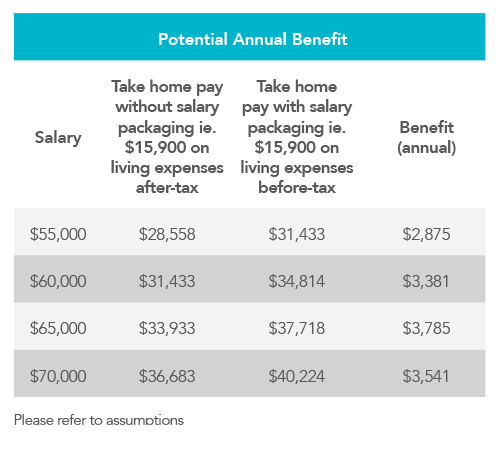

Could A Help Hecs Debt Impact My Salary Packaging Remserv

Queensland Health Hourly Pay In Australia Payscale

Aus Processing State Payroll Taxes For Australia

How To Calculate Taxes On Payroll Clearance 52 Off Www Ingeniovirtual Com